Warren Buffett is 80, wants to work past 100!

‘It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.’ — Warren Buffett

Warren Buffett, one of the world most successful investors, turns 80 on August 30, 2010. The world’s third richest man with a net worth of $47 billion continues to do what he likes the most: work, work and work.

When most people of his age lead a retired life, chairman of the Berkshire Hathaway is still actively involved with the company’s affairs and is yet to chalk out a succession plan.

His children will not inherit a significant proportion of his wealth. In an interview with The New York Times he had once said, “I don’t believe in dynastic wealth.”

“I plan to work past 100, but to do so I may have to learn to think outside the box,” Buffett said.

In 2007, Buffett beat Bill Gates to become the world’s richest man. Buffett’s journey to become the world’s richest is truly inspirational.

‘I always knew I was going to be rich. I don’t think I ever doubted it for a minute.’

Early years

As a young boy, Buffett, the son of a stockbroker, always yearned to make more money. He started making pocket money by delivering newspapers.

When he was just eleven years old, Buffett bought his first stock. He bought 6 shares of Cities Service preferred stock: 3 shares for himself, 3 for his sister, Doris, at $38 per share. The stock fell to $27 but went up to $40.

Warren and Doris sold their stock for a small margin. Immediately after that, the stock zoomed to $200 per share, much to his disappointment. That’s when he learnt a very important lesson in life: Patience pays!

A self-made billionaire, Buffett has a great memory and was always good at mathematics and business.

At the age of 14, with the money he had saved from part-time businesses and delivering newspapers, he bought a Nebraska farmland, which he later leased to a farmer.

‘If past history was all there was to the game, the richest people would be librarians.’

Stepping to success After his graduation from the University of Nebraska, he pursued further studies at the Columbia Graduate Business School under the legendary Benjamin Graham. He started his career with Graham where he learned a lot about stock investment.

He was deeply influenced by Benjamin Graham, an economist and proponent of value investing. A staunch follower of value investing, he buys shares of companies that are underpriced.

After Graham retired, Buffettt started a company in his native place Omaha funded by family and friends. It turned out to e a great success. Later, he set his eyes on buying stocks in Berkshire Hathaway.

Soon, Warren Buffettt has a majority holding in the company. When he bought into Berkshire Hathaway in 1965 it was about $18 a share — this week the price was hovering around $115,000 a share.

‘Price is what you pay. Value is what you get.’ A turning point Its annual return rate to investors since 1964 has averaged 20.3 per cent He set out to revive the company which was hit by high manufacturing costs. He helped Hathaway buy out two Nebraska insurance companies.

This was the turning point in Berkshire Hathaway. Since then there has been no looking back.

His friendship with lawyer and investor Charlie Munger further turned around his fortunes as well as the company’s. Munger joined Warren at Berkshire Hathaway as its vice chairman.

Under their leadership the company became well established. Today, the company has revenues of about $112.493 billion and net assets to the tune of $ 297.119 billion.

‘Someone’s sitting in the shade today because someone planted a tree a long time ago.’

A wealthy growth Berkshire Hathaway, headquartered in Omaha, Nebraska, US, manages a number of subsidiary companies. Berkshire Hathaway’s core business is insurance, including property and casualty insurance, reinsurance and specialty non-standard insurance.

Buffett had once told a friend that he will be a millionaire by the time he turns thirty. In 1983, Berkshire shares were at $775 per share, by the end of the year they rose to $1,310, and Buffett’s personal net worth zoomed to $620 million. He made it to the Forbes richest list for the first time.

For an investor who started off with $105,000 in 1956, it has been a meteoric rise. Over the next five decades, Buffett’s wealth rose to $62 billion.

‘Time is the friend of the wonderful company, the enemy of the mediocre.’

Words of wisdom

Buffett’s strategy for making money is very clear. “The first rule of investing is don’t lose money; the second rule is don’t forget Rule No. 1.”

Warren Buffett’s letters to shareholders are a treasure trove of information and packed with good strategies and loads of wise words. The letters give an insight into his thoughts, hopes and aspirations.

According to him, there are many rules to win the game. The first rule is not to lose. The second rule is not to forget the first rule.

Mistakes? An investor needs to do very few things right as long as he or she avoids big mistakes.

Want high value? Focus on return on equity, not earnings per share. Calculate ‘owner earnings’ to get a true reflection of value.

How to choose the right companies to invest? In the 2007 letter, he says Charlie and I look for companies that have a) a business we understand; b) favourable long-term economics; c) able and trustworthy management; and d) a sensible price tag.

‘Wall Street is the only place that people ride to in a Rolls Royce to get advice from those who take the subway.’

Great tips

What makes a great biz? Look for companies with high profit margins. A truly great business must have an enduring ‘moat’ that protects excellent returns on invested capital.

The dynamics of capitalism guarantee that competitors will repeatedly assault any business ‘castle’ that is earning high returns. When to say ‘yes’ and n’o’? The ability to say ‘no’ is a tremendous advantage for an investor.

Want great results? Always invest for the long term. It is not necessary to do extraordinary things to get extraordinary results.

Also known as ‘the Oracle of Omaha’, Buffett is also a notable philanthropist, having pledged to give away 85 per cent of his fortune to The Bill & Melinda Gates Foundation.

‘We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.’

Buffett’s family

Buffett was born to Howard and Leila Buffett on August 30, 1930, in Omaha, Nebraska. He was the second of three children, and the only boy. His father was a stockbroker and four-term United States congressman.

While Harvard rejected him, Buffett got acceptance from the Columbia University.

After completing his graduation, Buffett returned to Omaha to work at his father’s brokerage firm. He married Susan Thompson in 1952, and remained married to her for more than 50 years. His three children are Susie, Howard and Peter.

Buffett and Susan separated in 1977, remaining married until her death in 2004. Before her death, Susan introduced him to Astrid Menks. Buffett married Menks on his 76th birthday.

‘You only have to do a very few things right in your life so long as you don’t do too many things wrong.’

A frugal billionaire

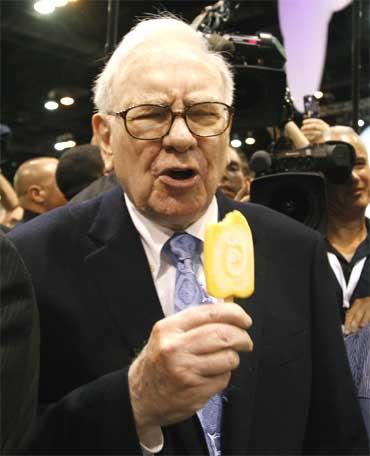

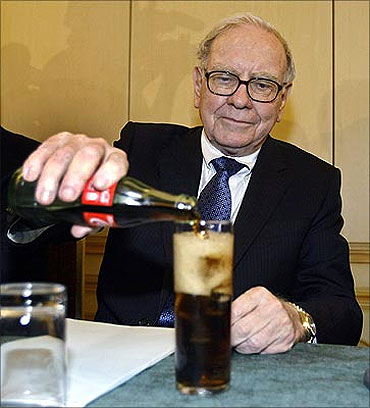

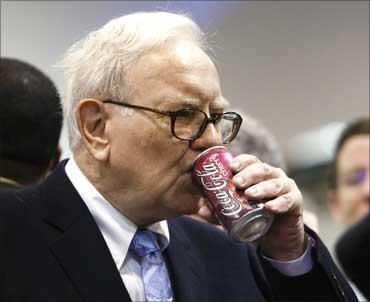

Buffett is well known for his simple tastes, including hamburgers and cherry Coke.

Despite a net worth measured in billions, Buffett’s base salary, at Berkshire Hathaway, for the past 25 years, has remained unchanged at $100,000 a year.

A frugal billionaire, he does not carry a cellphone, has no computer on his desk, drives his own car and does not have security guard with him.

He still lives in the same small 3 bedroom house in mid-town Omaha, that he bought after he got married 50 years ago. He says that he has everything he needs in that house. His house does not have a wall or a fence.

He drives his own car everywhere and does not have a driver or security people around him. He never travels by private jet, although he owns the world’s largest private jet company.

His advice to young people is: Stay away from credit cards and invest in yourself.

Image: Hedge fund manager Zhao Danyang (L) and his son Zhao Ziyang with Warren Buffett.

Photographs: Reuters.

‘In the business world, the rear view mirror is always clearer than the windshield.’

Buffett’s succession

Prem Jain, professor of accounting and finance at McDonough School of Business, Georgetown University, has written a book, Buffett Beyond Value. He talks about what one can learn from Buffett:

The most important thing you can learn is about your own psychology. You should find out whether you have a mindset to invest for 10 to 20 years. Do you become nervous when others are nervous?

For example, some of my friends sold their stocks when the market went down in 2008-2009. It is easy to say, ‘I will not sell when the market goes down,’ but it is not easy to implement.

You must understand that Buffett does not buy and sell quickly. On average, he holds stocks for 10 years. You should study the stock market history going back a few 100 years.

On his succession

It is not possible to replace Buffett. Right now, I feel Ajit Jain is the closest to Buffett and is likely to become the next chief executive officer. Buffett has mentioned that he talks to him every day.

Also, insurance is Berkshire’s main business and Ajit Jain is the CEO of a large insurance unit. If he does not want to be the CEO, there are several others in the company.

I believe no single person can step into Buffett’s shoes. Hence, it is possible that Berkshire’s management structure would be changed. In the long run, I can also see the company being split. Buffett’s son, Howard, is likely to become the non-executive chairman of the Berkshire board.

Source : Rediff