“No other commodity enjoys as much universal acceptability and marketability as does gold.” – Hans F. Sennholz

Radhika borrowed money to invest in 300 gm of gold bars. She rues not having bought gold at the beginning of the year when it was around Rs 13,000 per 10 gm. But she, like many others, believes it is still a solid investment and worth every penny. There are many like her who have rushed to buy gold in a country where gold has always been a safe investment bet.

After hitting Rs 16,000 per 10 gm in September 2009, gold prices zoomed to breach the Rs 18,500-mark in November.

Gold touched a all-time high of at Rs 18,550 per 10 gm in the bullion market on Thursday, then slipped a tad to end at Rs 18,210. Pure gold (99.9 purity), however, closed unchanged at at Rs 18,310 per 10 gm. Gold prices rallied to a fresh record highs above $1,225 an ounce in Europe after the dollar slid towards a 16-month low against the euro.

The price of gold reflects the value of the US dollar on which international trade is based as a common exchange currency. However, some analysts say there is possibility of a correction in gold prices due to profit booking. In the long run, the outlook for bullion market is strong as crude prices are rising and dollar is weakening.

Rediff Business Desk

“No other commodity enjoys as much universal acceptability and marketability as does gold.” – Hans F. Sennholz

Radhika borrowed money to invest in 300 gm of gold bars. She rues not having bought gold at the beginning of the year when it was around Rs 13,000 per 10 gm. But she, like many others, believes it is still a solid investment and worth every penny. There are many like her who have rushed to buy gold in a country where gold has always been a safe investment bet.After hitting Rs 16,000 per 10 gm in September 2009, gold prices zoomed to breach the Rs 18,500-mark in November.

Gold touched a all-time high of at Rs 18,550 per 10 gm in the bullion market on Thursday, then slipped a tad to end at Rs 18,210. Pure gold (99.9 purity), however, closed unchanged at at Rs 18,310 per 10 gm. Gold prices rallied to a fresh record highs above $1,225 an ounce in Europe after the dollar slid towards a 16-month low against the euro.

The price of gold reflects the value of the US dollar on which international trade is based as a common exchange currency. However, some analysts say there is possibility of a correction in gold prices due to profit booking. In the long run, the outlook for bullion market is strong as crude prices are rising and dollar is weakening.

So why is the price of gold rising? Is this a good time to invest in gold? Click on NEXT to find out…

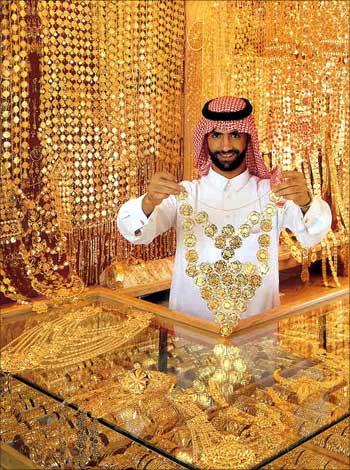

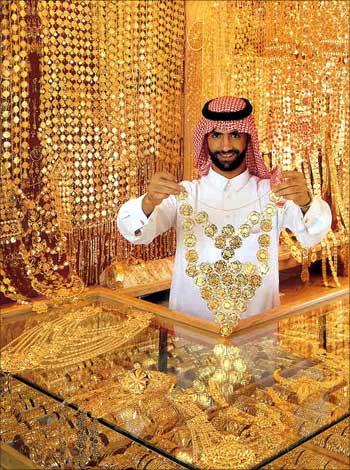

Image: Gold prices zoom.

Gold has continued to set new records and the prices have been rising over the years.

| Gold prices in India |

|

| March end

|

Gold price

per 10 gm

(Rs)

|

| 1925 |

18 |

| 1930 |

18 |

| 1935 |

30 |

| 1940 |

36 |

| 1945 |

62 |

| 1950 |

99 |

| 1955 |

79 |

| 1960 |

111 |

| 1965 |

71 |

|

|

| March end

|

Gold price

per 10 gm

(Rs) |

| 1970 |

184 |

| 1975 |

540 |

| 1980 |

1,330 |

| 1985 |

2,130 |

| 1990 |

3,200 |

| 1995 |

4,658 |

| 1996 |

5,713 |

| 1997 |

4,750 |

| 1998 |

4,050 |

|

|

| March end |

Gold price

per 10 gm

(Rs) |

| 1999 |

4,220 |

| 2000 |

4,395 |

| 2001 |

4,410 |

| 2002 |

5,030 |

| 2003 |

5,260 |

| 2004 |

6,005 |

| 2005 |

6,165 |

| 2006 |

8,210 |

| 2007 |

9,500 |

|

Domestic gold prices hit a high of nearly Rs 13,100 in March 2008.

Gold prices closed at all-time record of over Rs 18,000-per ten gram in November 2009 the back of a strong marriage season demand, positive global cues and a weaker dollar. Gold prices rose by 13 per cent since the beginning of this month after the Reserve Bank of India announced it had bought 200 tonnes of bullion from the IMF.

Retail investment demand for gold has zoomed by 515.8 per cent to 109 tonnes in the second quarter (April-June) of 2009 from 17.7 tonnes in the first quarter.

India consumes nearly 30 per cent of the world’s annual gold production. This is slated to increase by 36 per cent to 980 tonnes by 2010 according to the Indian Chamber of Commerce.

Reasons for the rise:

Dollar crisis: A weak dollar in the wake of the recession has forced people to invest in gold which in the long run would fetch more returns. Dollar is likely to weaken further leading to a further rise in gold prices.

Low saving rate: With banks offering lower interest rates, fixed deposits make little sense. It is cheaper to even borrow money to invest in gold.

Rediff Business Desk

“No other commodity enjoys as much universal acceptability and marketability as does gold.” – Hans F. Sennholz

Radhika borrowed money to invest in 300 gm of gold bars. She rues not having bought gold at the beginning of the year when it was around Rs 13,000 per 10 gm. But she, like many others, believes it is still a solid investment and worth every penny. There are many like her who have rushed to buy gold in a country where gold has always been a safe investment bet.After hitting Rs 16,000 per 10 gm in September 2009, gold prices zoomed to breach the Rs 18,500-mark in November.

Gold touched a all-time high of at Rs 18,550 per 10 gm in the bullion market on Thursday, then slipped a tad to end at Rs 18,210. Pure gold (99.9 purity), however, closed unchanged at at Rs 18,310 per 10 gm. Gold prices rallied to a fresh record highs above $1,225 an ounce in Europe after the dollar slid towards a 16-month low against the euro.

The price of gold reflects the value of the US dollar on which international trade is based as a common exchange currency. However, some analysts say there is possibility of a correction in gold prices due to profit booking. In the long run, the outlook for bullion market is strong as crude prices are rising and dollar is weakening.

So why is the price of gold rising? Is this a good time to invest in gold? Click on NEXT to find out…

Image: Gold prices zoom.

Gold has continued to set new records and the prices have been rising over the years.

|

Gold prices in India |

|

| March end

|

Gold price

per 10 gm

(Rs)

|

| 1925 |

18 |

| 1930 |

18 |

| 1935 |

30 |

| 1940 |

36 |

| 1945 |

62 |

| 1950 |

99 |

| 1955 |

79 |

| 1960 |

111 |

| 1965 |

71 |

|

|

| March end

|

Gold price

per 10 gm

(Rs) |

| 1970 |

184 |

| 1975 |

540 |

| 1980 |

1,330 |

| 1985 |

2,130 |

| 1990 |

3,200 |

| 1995 |

4,658 |

| 1996 |

5,713 |

| 1997 |

4,750 |

| 1998 |

4,050 |

|

|

| March end |

Gold price

per 10 gm

(Rs) |

| 1999 |

4,220 |

| 2000 |

4,395 |

| 2001 |

4,410 |

| 2002 |

5,030 |

| 2003 |

5,260 |

| 2004 |

6,005 |

| 2005 |

6,165 |

| 2006 |

8,210 |

| 2007 |

9,500 |

|

Domestic gold prices hit a high of nearly Rs 13,100 in March 2008.

Gold prices closed at all-time record of over Rs 18,000-per ten gram in November 2009 the back of a strong marriage season demand, positive global cues and a weaker dollar. Gold prices rose by 13 per cent since the beginning of this month after the Reserve Bank of India announced it had bought 200 tonnes of bullion from the IMF.

Retail investment demand for gold has zoomed by 515.8 per cent to 109 tonnes in the second quarter (April-June) of 2009 from 17.7 tonnes in the first quarter.

India consumes nearly 30 per cent of the world’s annual gold production. This is slated to increase by 36 per cent to 980 tonnes by 2010 according to the Indian Chamber of Commerce.

Reasons for the rise:

Dollar crisis: A weak dollar in the wake of the recession has forced people to invest in gold which in the long run would fetch more returns. Dollar is likely to weaken further leading to a further rise in gold prices.

Low saving rate: With banks offering lower interest rates, fixed deposits make little sense. It is cheaper to even borrow money to invest in gold.

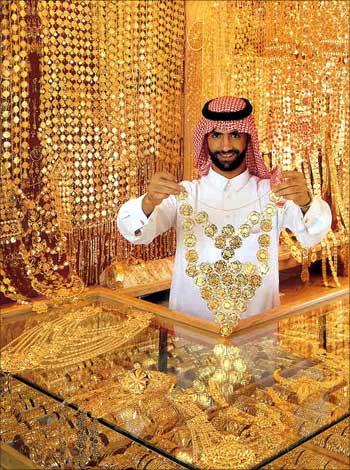

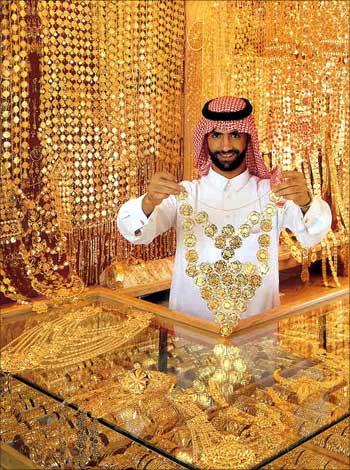

Image: A weak dollar leads to a rise in prices.

Inflation: Gold has always been a good tool to fight inflation. Rising inflation rate appreciates gold prices. With inflation rising to record highs, gold will prove to be a safe bet.

Economic crisis: Gold has always given high returns over a long term. As the crisis triggered a fall in markets across the globe, many investors wary of investing in stocks or bonds, found refuge in gold. Gold is globally accepted and easily convertible into cash.

A fall in gold supply: Gold mining is decreasing and the demand for gold is increasing. Gold supply has decreased by almost 40 per cent as the cost of mining, legal formalities and geographical problems have increased which has led to a fall in gold mining.

Rediff Business Desk

“No other commodity enjoys as much universal acceptability and marketability as does gold.” – Hans F. Sennholz

Radhika borrowed money to invest in 300 gm of gold bars. She rues not having bought gold at the beginning of the year when it was around Rs 13,000 per 10 gm. But she, like many others, believes it is still a solid investment and worth every penny. There are many like her who have rushed to buy gold in a country where gold has always been a safe investment bet.After hitting Rs 16,000 per 10 gm in September 2009, gold prices zoomed to breach the Rs 18,500-mark in November.

Gold touched a all-time high of at Rs 18,550 per 10 gm in the bullion market on Thursday, then slipped a tad to end at Rs 18,210. Pure gold (99.9 purity), however, closed unchanged at at Rs 18,310 per 10 gm. Gold prices rallied to a fresh record highs above $1,225 an ounce in Europe after the dollar slid towards a 16-month low against the euro.

The price of gold reflects the value of the US dollar on which international trade is based as a common exchange currency. However, some analysts say there is possibility of a correction in gold prices due to profit booking. In the long run, the outlook for bullion market is strong as crude prices are rising and dollar is weakening.

So why is the price of gold rising? Is this a good time to invest in gold? Click on NEXT to find out…

Image: Gold prices zoom.

Gold has continued to set new records and the prices have been rising over the years.

|

Gold prices in India |

|

| March end

|

Gold price

per 10 gm

(Rs)

|

| 1925 |

18 |

| 1930 |

18 |

| 1935 |

30 |

| 1940 |

36 |

| 1945 |

62 |

| 1950 |

99 |

| 1955 |

79 |

| 1960 |

111 |

| 1965 |

71 |

|

|

| March end

|

Gold price

per 10 gm

(Rs) |

| 1970 |

184 |

| 1975 |

540 |

| 1980 |

1,330 |

| 1985 |

2,130 |

| 1990 |

3,200 |

| 1995 |

4,658 |

| 1996 |

5,713 |

| 1997 |

4,750 |

| 1998 |

4,050 |

|

|

| March end |

Gold price

per 10 gm

(Rs) |

| 1999 |

4,220 |

| 2000 |

4,395 |

| 2001 |

4,410 |

| 2002 |

5,030 |

| 2003 |

5,260 |

| 2004 |

6,005 |

| 2005 |

6,165 |

| 2006 |

8,210 |

| 2007 |

9,500 |

|

Domestic gold prices hit a high of nearly Rs 13,100 in March 2008.

Gold prices closed at all-time record of over Rs 18,000-per ten gram in November 2009 the back of a strong marriage season demand, positive global cues and a weaker dollar. Gold prices rose by 13 per cent since the beginning of this month after the Reserve Bank of India announced it had bought 200 tonnes of bullion from the IMF.

Retail investment demand for gold has zoomed by 515.8 per cent to 109 tonnes in the second quarter (April-June) of 2009 from 17.7 tonnes in the first quarter.

India consumes nearly 30 per cent of the world’s annual gold production. This is slated to increase by 36 per cent to 980 tonnes by 2010 according to the Indian Chamber of Commerce.

Reasons for the rise:

Dollar crisis: A weak dollar in the wake of the recession has forced people to invest in gold which in the long run would fetch more returns. Dollar is likely to weaken further leading to a further rise in gold prices.

Low saving rate: With banks offering lower interest rates, fixed deposits make little sense. It is cheaper to even borrow money to invest in gold.

Image: A weak dollar leads to a rise in prices.

Inflation: Gold has always been a good tool to fight inflation. Rising inflation rate appreciates gold prices. With inflation rising to record highs, gold will prove to be a safe bet.Economic crisis: Gold has always given high returns over a long term. As the crisis triggered a fall in markets across the globe, many investors wary of investing in stocks or bonds, found refuge in gold. Gold is globally accepted and easily convertible into cash.

A fall in gold supply: Gold mining is decreasing and the demand for gold is increasing. Gold supply has decreased by almost 40 per cent as the cost of mining, legal formalities and geographical problems have increased which has led to a fall in gold mining.

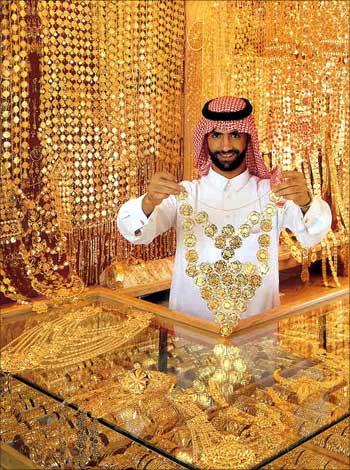

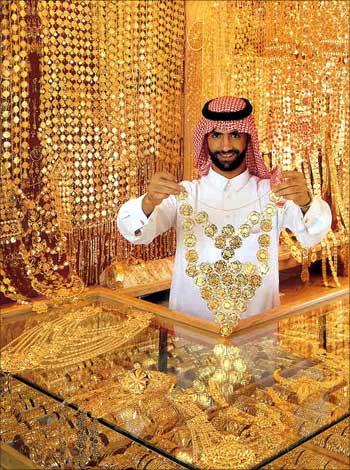

Image: Gold has always given high returns.

US interest rates: The interest rates affect gold prices. Whenever interest rates fall, gold prices rise. Lowering interest rates increases gold prices as gold becomes a better investment option.

Political concerns, crisis: Whenever there is a crisis, war, terrorist attack etc, investors rush to prevent erosion of their investments and gold as a safe haven. After 9/11 terror attacks in the United States, the demand for gold had gone up.

Festivals: Indians are among the largest consumers of gold. Gold has been used as ornaments and gifted during festivals and weddings. So there is a huge demand for gold during the festive season.

Rediff Business Desk

“No other commodity enjoys as much universal acceptability and marketability as does gold.” – Hans F. Sennholz

Radhika borrowed money to invest in 300 gm of gold bars. She rues not having bought gold at the beginning of the year when it was around Rs 13,000 per 10 gm. But she, like many others, believes it is still a solid investment and worth every penny. There are many like her who have rushed to buy gold in a country where gold has always been a safe investment bet.After hitting Rs 16,000 per 10 gm in September 2009, gold prices zoomed to breach the Rs 18,500-mark in November.

Gold touched a all-time high of at Rs 18,550 per 10 gm in the bullion market on Thursday, then slipped a tad to end at Rs 18,210. Pure gold (99.9 purity), however, closed unchanged at at Rs 18,310 per 10 gm. Gold prices rallied to a fresh record highs above $1,225 an ounce in Europe after the dollar slid towards a 16-month low against the euro.

The price of gold reflects the value of the US dollar on which international trade is based as a common exchange currency. However, some analysts say there is possibility of a correction in gold prices due to profit booking. In the long run, the outlook for bullion market is strong as crude prices are rising and dollar is weakening.

So why is the price of gold rising? Is this a good time to invest in gold? Click on NEXT to find out…

Image: Gold prices zoom.

Gold has continued to set new records and the prices have been rising over the years.

|

Gold prices in India |

|

| March end

|

Gold price

per 10 gm

(Rs)

|

| 1925 |

18 |

| 1930 |

18 |

| 1935 |

30 |

| 1940 |

36 |

| 1945 |

62 |

| 1950 |

99 |

| 1955 |

79 |

| 1960 |

111 |

| 1965 |

71 |

|

|

| March end

|

Gold price

per 10 gm

(Rs) |

| 1970 |

184 |

| 1975 |

540 |

| 1980 |

1,330 |

| 1985 |

2,130 |

| 1990 |

3,200 |

| 1995 |

4,658 |

| 1996 |

5,713 |

| 1997 |

4,750 |

| 1998 |

4,050 |

|

|

| March end |

Gold price

per 10 gm

(Rs) |

| 1999 |

4,220 |

| 2000 |

4,395 |

| 2001 |

4,410 |

| 2002 |

5,030 |

| 2003 |

5,260 |

| 2004 |

6,005 |

| 2005 |

6,165 |

| 2006 |

8,210 |

| 2007 |

9,500 |

|

Domestic gold prices hit a high of nearly Rs 13,100 in March 2008.

Gold prices closed at all-time record of over Rs 18,000-per ten gram in November 2009 the back of a strong marriage season demand, positive global cues and a weaker dollar. Gold prices rose by 13 per cent since the beginning of this month after the Reserve Bank of India announced it had bought 200 tonnes of bullion from the IMF.

Retail investment demand for gold has zoomed by 515.8 per cent to 109 tonnes in the second quarter (April-June) of 2009 from 17.7 tonnes in the first quarter.

India consumes nearly 30 per cent of the world’s annual gold production. This is slated to increase by 36 per cent to 980 tonnes by 2010 according to the Indian Chamber of Commerce.

Reasons for the rise:

Dollar crisis: A weak dollar in the wake of the recession has forced people to invest in gold which in the long run would fetch more returns. Dollar is likely to weaken further leading to a further rise in gold prices.

Low saving rate: With banks offering lower interest rates, fixed deposits make little sense. It is cheaper to even borrow money to invest in gold.

Image: A weak dollar leads to a rise in prices.

Inflation: Gold has always been a good tool to fight inflation. Rising inflation rate appreciates gold prices. With inflation rising to record highs, gold will prove to be a safe bet.Economic crisis: Gold has always given high returns over a long term. As the crisis triggered a fall in markets across the globe, many investors wary of investing in stocks or bonds, found refuge in gold. Gold is globally accepted and easily convertible into cash.

A fall in gold supply: Gold mining is decreasing and the demand for gold is increasing. Gold supply has decreased by almost 40 per cent as the cost of mining, legal formalities and geographical problems have increased which has led to a fall in gold mining.

Image: Gold has always given high returns.

US interest rates: The interest rates affect gold prices. Whenever interest rates fall, gold prices rise. Lowering interest rates increases gold prices as gold becomes a better investment option.

Political concerns, crisis: Whenever there is a crisis, war, terrorist attack etc, investors rush to prevent erosion of their investments and gold as a safe haven. After 9/11 terror attacks in the United States, the demand for gold had gone up.

Festivals: Indians are among the largest consumers of gold. Gold has been used as ornaments and gifted during festivals and weddings. So there is a huge demand for gold during the festive season.

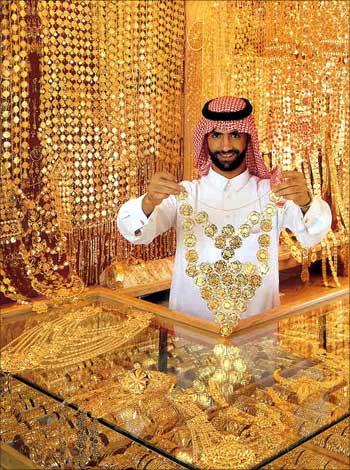

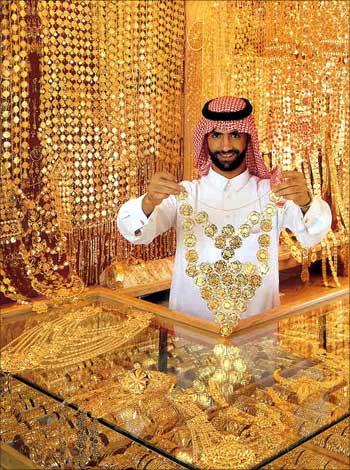

Image: Indians are among the largest consumers of gold.

Why invest in gold

High value and liquidity: It can be converted into cash and hence it is a highly liquid asset.

Good security: It is easy to get a loan banks since banks accept gold as security.

Investment in gold bonds: The other option is to invest in gold bonds or certificates issued by commercial banks. These bonds generally carry low interest rates and a lock-in period varying from three years to seven years. On maturity, depositors can take the delivery of gold or amount equivalent depending on their options.

No income tax: Since there is no regular income from investment in gold, the income will not be subjected to tax.

Stable investment: Gold pricing is not volatile so it remains stable. It is more stable than currencies.

Gold bars, coins: It is better to have 5-10 per cent of your net assets as gold. You can invest in gold bars and coins. You may not get a good price for jewellery because of making and processing charges involved in it. Smaller bars are more expensive than large bars but are easier to sell. Bars carry a higher price premium than coins.

Hallmark: Look for hallmark or BIS sign on gold bars and coins. It is a sign of quality and purity. Buy only from a known dealer or bank. It is better to buy gold coins and gold bars from banks like HDFC Bank, State Bank of Mysore, Bank of Baroda, Canara Bank, Corporation bank, ICICI Bank etc.

Rediff Business Desk

“No other commodity enjoys as much universal acceptability and marketability as does gold.” – Hans F. Sennholz

Radhika borrowed money to invest in 300 gm of gold bars. She rues not having bought gold at the beginning of the year when it was around Rs 13,000 per 10 gm. But she, like many others, believes it is still a solid investment and worth every penny. There are many like her who have rushed to buy gold in a country where gold has always been a safe investment bet.After hitting Rs 16,000 per 10 gm in September 2009, gold prices zoomed to breach the Rs 18,500-mark in November.

Gold touched a all-time high of at Rs 18,550 per 10 gm in the bullion market on Thursday, then slipped a tad to end at Rs 18,210. Pure gold (99.9 purity), however, closed unchanged at at Rs 18,310 per 10 gm. Gold prices rallied to a fresh record highs above $1,225 an ounce in Europe after the dollar slid towards a 16-month low against the euro.

The price of gold reflects the value of the US dollar on which international trade is based as a common exchange currency. However, some analysts say there is possibility of a correction in gold prices due to profit booking. In the long run, the outlook for bullion market is strong as crude prices are rising and dollar is weakening.

So why is the price of gold rising? Is this a good time to invest in gold? Click on NEXT to find out…

Image: Gold prices zoom.

Gold has continued to set new records and the prices have been rising over the years.

|

Gold prices in India |

|

| March end

|

Gold price

per 10 gm

(Rs)

|

| 1925 |

18 |

| 1930 |

18 |

| 1935 |

30 |

| 1940 |

36 |

| 1945 |

62 |

| 1950 |

99 |

| 1955 |

79 |

| 1960 |

111 |

| 1965 |

71 |

|

|

| March end

|

Gold price

per 10 gm

(Rs) |

| 1970 |

184 |

| 1975 |

540 |

| 1980 |

1,330 |

| 1985 |

2,130 |

| 1990 |

3,200 |

| 1995 |

4,658 |

| 1996 |

5,713 |

| 1997 |

4,750 |

| 1998 |

4,050 |

|

|

| March end |

Gold price

per 10 gm

(Rs) |

| 1999 |

4,220 |

| 2000 |

4,395 |

| 2001 |

4,410 |

| 2002 |

5,030 |

| 2003 |

5,260 |

| 2004 |

6,005 |

| 2005 |

6,165 |

| 2006 |

8,210 |

| 2007 |

9,500 |

|

Domestic gold prices hit a high of nearly Rs 13,100 in March 2008.

Gold prices closed at all-time record of over Rs 18,000-per ten gram in November 2009 the back of a strong marriage season demand, positive global cues and a weaker dollar. Gold prices rose by 13 per cent since the beginning of this month after the Reserve Bank of India announced it had bought 200 tonnes of bullion from the IMF.

Retail investment demand for gold has zoomed by 515.8 per cent to 109 tonnes in the second quarter (April-June) of 2009 from 17.7 tonnes in the first quarter.

India consumes nearly 30 per cent of the world’s annual gold production. This is slated to increase by 36 per cent to 980 tonnes by 2010 according to the Indian Chamber of Commerce.

Reasons for the rise:

Dollar crisis: A weak dollar in the wake of the recession has forced people to invest in gold which in the long run would fetch more returns. Dollar is likely to weaken further leading to a further rise in gold prices.

Low saving rate: With banks offering lower interest rates, fixed deposits make little sense. It is cheaper to even borrow money to invest in gold.

Image: A weak dollar leads to a rise in prices.

Inflation: Gold has always been a good tool to fight inflation. Rising inflation rate appreciates gold prices. With inflation rising to record highs, gold will prove to be a safe bet.Economic crisis: Gold has always given high returns over a long term. As the crisis triggered a fall in markets across the globe, many investors wary of investing in stocks or bonds, found refuge in gold. Gold is globally accepted and easily convertible into cash.

A fall in gold supply: Gold mining is decreasing and the demand for gold is increasing. Gold supply has decreased by almost 40 per cent as the cost of mining, legal formalities and geographical problems have increased which has led to a fall in gold mining.

Image: Gold has always given high returns.

US interest rates: The interest rates affect gold prices. Whenever interest rates fall, gold prices rise. Lowering interest rates increases gold prices as gold becomes a better investment option.

Political concerns, crisis: Whenever there is a crisis, war, terrorist attack etc, investors rush to prevent erosion of their investments and gold as a safe haven. After 9/11 terror attacks in the United States, the demand for gold had gone up.

Festivals: Indians are among the largest consumers of gold. Gold has been used as ornaments and gifted during festivals and weddings. So there is a huge demand for gold during the festive season.

Image: Indians are among the largest consumers of gold.

Why invest in gold

High value and liquidity: It can be converted into cash and hence it is a highly liquid asset.

Good security: It is easy to get a loan banks since banks accept gold as security.

Investment in gold bonds: The other option is to invest in gold bonds or certificates issued by commercial banks. These bonds generally carry low interest rates and a lock-in period varying from three years to seven years. On maturity, depositors can take the delivery of gold or amount equivalent depending on their options.

No income tax: Since there is no regular income from investment in gold, the income will not be subjected to tax.

Stable investment: Gold pricing is not volatile so it remains stable. It is more stable than currencies.

Gold bars, coins: It is better to have 5-10 per cent of your net assets as gold. You can invest in gold bars and coins. You may not get a good price for jewellery because of making and processing charges involved in it. Smaller bars are more expensive than large bars but are easier to sell. Bars carry a higher price premium than coins.

Hallmark: Look for hallmark or BIS sign on gold bars and coins. It is a sign of quality and purity. Buy only from a known dealer or bank. It is better to buy gold coins and gold bars from banks like HDFC Bank, State Bank of Mysore, Bank of Baroda, Canara Bank, Corporation bank, ICICI Bank etc.

Image: Look for hallmark or BIS sign on gold bars and coins.

Gold Deposit Scheme

You can deposit a minimum of 200 gm of gold with no upper limit, in exchange for gold bonds carrying a tax-free interest of 3 to 4 per cent depending upon the tenure of the bond ranging from 3 to 7 years. These bonds are free from wealth tax and capital gains tax. The principal can be collected back in gold or cash at the investor’s option. Gold ETFsThere has been a rise in the Gold Exchange Traded Funds (ETFs). ETFs are mutual funds that stock up gold and then issue units for the same value for investors to trade.

ETFs allow normal investors to hold gold electronically in paperless form. According to World Gold Council estimates, ETF demand for gold in the first half of 2009 stood at over 500 tonnes, three times their annual levels five years ago.

Rediff Business Desk

“No other commodity enjoys as much universal acceptability and marketability as does gold.” – Hans F. Sennholz

Radhika borrowed money to invest in 300 gm of gold bars. She rues not having bought gold at the beginning of the year when it was around Rs 13,000 per 10 gm. But she, like many others, believes it is still a solid investment and worth every penny. There are many like her who have rushed to buy gold in a country where gold has always been a safe investment bet.After hitting Rs 16,000 per 10 gm in September 2009, gold prices zoomed to breach the Rs 18,500-mark in November.

Gold touched a all-time high of at Rs 18,550 per 10 gm in the bullion market on Thursday, then slipped a tad to end at Rs 18,210. Pure gold (99.9 purity), however, closed unchanged at at Rs 18,310 per 10 gm. Gold prices rallied to a fresh record highs above $1,225 an ounce in Europe after the dollar slid towards a 16-month low against the euro.

The price of gold reflects the value of the US dollar on which international trade is based as a common exchange currency. However, some analysts say there is possibility of a correction in gold prices due to profit booking. In the long run, the outlook for bullion market is strong as crude prices are rising and dollar is weakening.

So why is the price of gold rising? Is this a good time to invest in gold? Click on NEXT to find out…

Image: Gold prices zoom.

Gold has continued to set new records and the prices have been rising over the years.

|

Gold prices in India |

|

| March end

|

Gold price

per 10 gm

(Rs)

|

| 1925 |

18 |

| 1930 |

18 |

| 1935 |

30 |

| 1940 |

36 |

| 1945 |

62 |

| 1950 |

99 |

| 1955 |

79 |

| 1960 |

111 |

| 1965 |

71 |

|

|

| March end

|

Gold price

per 10 gm

(Rs) |

| 1970 |

184 |

| 1975 |

540 |

| 1980 |

1,330 |

| 1985 |

2,130 |

| 1990 |

3,200 |

| 1995 |

4,658 |

| 1996 |

5,713 |

| 1997 |

4,750 |

| 1998 |

4,050 |

|

|

| March end |

Gold price

per 10 gm

(Rs) |

| 1999 |

4,220 |

| 2000 |

4,395 |

| 2001 |

4,410 |

| 2002 |

5,030 |

| 2003 |

5,260 |

| 2004 |

6,005 |

| 2005 |

6,165 |

| 2006 |

8,210 |

| 2007 |

9,500 |

|

Domestic gold prices hit a high of nearly Rs 13,100 in March 2008.

Gold prices closed at all-time record of over Rs 18,000-per ten gram in November 2009 the back of a strong marriage season demand, positive global cues and a weaker dollar. Gold prices rose by 13 per cent since the beginning of this month after the Reserve Bank of India announced it had bought 200 tonnes of bullion from the IMF.

Retail investment demand for gold has zoomed by 515.8 per cent to 109 tonnes in the second quarter (April-June) of 2009 from 17.7 tonnes in the first quarter.

India consumes nearly 30 per cent of the world’s annual gold production. This is slated to increase by 36 per cent to 980 tonnes by 2010 according to the Indian Chamber of Commerce.

Reasons for the rise:

Dollar crisis: A weak dollar in the wake of the recession has forced people to invest in gold which in the long run would fetch more returns. Dollar is likely to weaken further leading to a further rise in gold prices.

Low saving rate: With banks offering lower interest rates, fixed deposits make little sense. It is cheaper to even borrow money to invest in gold.

Image: A weak dollar leads to a rise in prices.

Inflation: Gold has always been a good tool to fight inflation. Rising inflation rate appreciates gold prices. With inflation rising to record highs, gold will prove to be a safe bet.Economic crisis: Gold has always given high returns over a long term. As the crisis triggered a fall in markets across the globe, many investors wary of investing in stocks or bonds, found refuge in gold. Gold is globally accepted and easily convertible into cash.

A fall in gold supply: Gold mining is decreasing and the demand for gold is increasing. Gold supply has decreased by almost 40 per cent as the cost of mining, legal formalities and geographical problems have increased which has led to a fall in gold mining.

Image: Gold has always given high returns.

US interest rates: The interest rates affect gold prices. Whenever interest rates fall, gold prices rise. Lowering interest rates increases gold prices as gold becomes a better investment option.

Political concerns, crisis: Whenever there is a crisis, war, terrorist attack etc, investors rush to prevent erosion of their investments and gold as a safe haven. After 9/11 terror attacks in the United States, the demand for gold had gone up.

Festivals: Indians are among the largest consumers of gold. Gold has been used as ornaments and gifted during festivals and weddings. So there is a huge demand for gold during the festive season.

Image: Indians are among the largest consumers of gold.

Why invest in gold

High value and liquidity: It can be converted into cash and hence it is a highly liquid asset.

Good security: It is easy to get a loan banks since banks accept gold as security.

Investment in gold bonds: The other option is to invest in gold bonds or certificates issued by commercial banks. These bonds generally carry low interest rates and a lock-in period varying from three years to seven years. On maturity, depositors can take the delivery of gold or amount equivalent depending on their options.

No income tax: Since there is no regular income from investment in gold, the income will not be subjected to tax.

Stable investment: Gold pricing is not volatile so it remains stable. It is more stable than currencies.

Gold bars, coins: It is better to have 5-10 per cent of your net assets as gold. You can invest in gold bars and coins. You may not get a good price for jewellery because of making and processing charges involved in it. Smaller bars are more expensive than large bars but are easier to sell. Bars carry a higher price premium than coins.

Hallmark: Look for hallmark or BIS sign on gold bars and coins. It is a sign of quality and purity. Buy only from a known dealer or bank. It is better to buy gold coins and gold bars from banks like HDFC Bank, State Bank of Mysore, Bank of Baroda, Canara Bank, Corporation bank, ICICI Bank etc.

Image: Look for hallmark or BIS sign on gold bars and coins.

Gold Deposit Scheme

You can deposit a minimum of 200 gm of gold with no upper limit, in exchange for gold bonds carrying a tax-free interest of 3 to 4 per cent depending upon the tenure of the bond ranging from 3 to 7 years. These bonds are free from wealth tax and capital gains tax. The principal can be collected back in gold or cash at the investor’s option. Gold ETFsThere has been a rise in the Gold Exchange Traded Funds (ETFs). ETFs are mutual funds that stock up gold and then issue units for the same value for investors to trade.

ETFs allow normal investors to hold gold electronically in paperless form. According to World Gold Council estimates, ETF demand for gold in the first half of 2009 stood at over 500 tonnes, three times their annual levels five years ago.

Image: A rise in the Gold Exchange Traded Funds.

W

With the dollar losing its value, central banks of most of the developed countries have started to increase their share of gold. So there is a huge demand for gold.

The bulk of this growth will come from Asia led by China, India and the Middle East and is likely to have an immense impact on global precious metals demand. A high gold price is an indicator that all is not well with the global economy.

Here’s how emerging nations like India, China countries are triggering a demand for gold.

The India factor

Gold has always been a popular investment both jewellery and bullion in countries like India and China. India is the world’s largest consumer of gold. With a population of 1.1 billion people, gold has a great future in India. The Indian wedding season from December to May adds to the demand in gold. Any festive occasion is India sees a spurt in the demand. People even mortgage their properties to buy gold in India.

Rediff Business Desk

“No other commodity enjoys as much universal acceptability and marketability as does gold.” – Hans F. Sennholz

Radhika borrowed money to invest in 300 gm of gold bars. She rues not having bought gold at the beginning of the year when it was around Rs 13,000 per 10 gm. But she, like many others, believes it is still a solid investment and worth every penny. There are many like her who have rushed to buy gold in a country where gold has always been a safe investment bet.After hitting Rs 16,000 per 10 gm in September 2009, gold prices zoomed to breach the Rs 18,500-mark in November.

Gold touched a all-time high of at Rs 18,550 per 10 gm in the bullion market on Thursday, then slipped a tad to end at Rs 18,210. Pure gold (99.9 purity), however, closed unchanged at at Rs 18,310 per 10 gm. Gold prices rallied to a fresh record highs above $1,225 an ounce in Europe after the dollar slid towards a 16-month low against the euro.

The price of gold reflects the value of the US dollar on which international trade is based as a common exchange currency. However, some analysts say there is possibility of a correction in gold prices due to profit booking. In the long run, the outlook for bullion market is strong as crude prices are rising and dollar is weakening.

So why is the price of gold rising? Is this a good time to invest in gold? Click on NEXT to find out…

Image: Gold prices zoom.

Gold has continued to set new records and the prices have been rising over the years.

|

Gold prices in India |

|

| March end

|

Gold price

per 10 gm

(Rs)

|

| 1925 |

18 |

| 1930 |

18 |

| 1935 |

30 |

| 1940 |

36 |

| 1945 |

62 |

| 1950 |

99 |

| 1955 |

79 |

| 1960 |

111 |

| 1965 |

71 |

|

|

| March end

|

Gold price

per 10 gm

(Rs) |

| 1970 |

184 |

| 1975 |

540 |

| 1980 |

1,330 |

| 1985 |

2,130 |

| 1990 |

3,200 |

| 1995 |

4,658 |

| 1996 |

5,713 |

| 1997 |

4,750 |

| 1998 |

4,050 |

|

|

| March end |

Gold price

per 10 gm

(Rs) |

| 1999 |

4,220 |

| 2000 |

4,395 |

| 2001 |

4,410 |

| 2002 |

5,030 |

| 2003 |

5,260 |

| 2004 |

6,005 |

| 2005 |

6,165 |

| 2006 |

8,210 |

| 2007 |

9,500 |

|

Domestic gold prices hit a high of nearly Rs 13,100 in March 2008.

Gold prices closed at all-time record of over Rs 18,000-per ten gram in November 2009 the back of a strong marriage season demand, positive global cues and a weaker dollar. Gold prices rose by 13 per cent since the beginning of this month after the Reserve Bank of India announced it had bought 200 tonnes of bullion from the IMF.

Retail investment demand for gold has zoomed by 515.8 per cent to 109 tonnes in the second quarter (April-June) of 2009 from 17.7 tonnes in the first quarter.

India consumes nearly 30 per cent of the world’s annual gold production. This is slated to increase by 36 per cent to 980 tonnes by 2010 according to the Indian Chamber of Commerce.

Reasons for the rise:

Dollar crisis: A weak dollar in the wake of the recession has forced people to invest in gold which in the long run would fetch more returns. Dollar is likely to weaken further leading to a further rise in gold prices.

Low saving rate: With banks offering lower interest rates, fixed deposits make little sense. It is cheaper to even borrow money to invest in gold.

Image: A weak dollar leads to a rise in prices.

Inflation: Gold has always been a good tool to fight inflation. Rising inflation rate appreciates gold prices. With inflation rising to record highs, gold will prove to be a safe bet.Economic crisis: Gold has always given high returns over a long term. As the crisis triggered a fall in markets across the globe, many investors wary of investing in stocks or bonds, found refuge in gold. Gold is globally accepted and easily convertible into cash.

A fall in gold supply: Gold mining is decreasing and the demand for gold is increasing. Gold supply has decreased by almost 40 per cent as the cost of mining, legal formalities and geographical problems have increased which has led to a fall in gold mining.

Image: Gold has always given high returns.

US interest rates: The interest rates affect gold prices. Whenever interest rates fall, gold prices rise. Lowering interest rates increases gold prices as gold becomes a better investment option.

Political concerns, crisis: Whenever there is a crisis, war, terrorist attack etc, investors rush to prevent erosion of their investments and gold as a safe haven. After 9/11 terror attacks in the United States, the demand for gold had gone up.

Festivals: Indians are among the largest consumers of gold. Gold has been used as ornaments and gifted during festivals and weddings. So there is a huge demand for gold during the festive season.

Image: Indians are among the largest consumers of gold.

Why invest in gold

High value and liquidity: It can be converted into cash and hence it is a highly liquid asset.

Good security: It is easy to get a loan banks since banks accept gold as security.

Investment in gold bonds: The other option is to invest in gold bonds or certificates issued by commercial banks. These bonds generally carry low interest rates and a lock-in period varying from three years to seven years. On maturity, depositors can take the delivery of gold or amount equivalent depending on their options.

No income tax: Since there is no regular income from investment in gold, the income will not be subjected to tax.

Stable investment: Gold pricing is not volatile so it remains stable. It is more stable than currencies.

Gold bars, coins: It is better to have 5-10 per cent of your net assets as gold. You can invest in gold bars and coins. You may not get a good price for jewellery because of making and processing charges involved in it. Smaller bars are more expensive than large bars but are easier to sell. Bars carry a higher price premium than coins.

Hallmark: Look for hallmark or BIS sign on gold bars and coins. It is a sign of quality and purity. Buy only from a known dealer or bank. It is better to buy gold coins and gold bars from banks like HDFC Bank, State Bank of Mysore, Bank of Baroda, Canara Bank, Corporation bank, ICICI Bank etc.

Image: Look for hallmark or BIS sign on gold bars and coins.

Gold Deposit Scheme

You can deposit a minimum of 200 gm of gold with no upper limit, in exchange for gold bonds carrying a tax-free interest of 3 to 4 per cent depending upon the tenure of the bond ranging from 3 to 7 years. These bonds are free from wealth tax and capital gains tax. The principal can be collected back in gold or cash at the investor’s option. Gold ETFsThere has been a rise in the Gold Exchange Traded Funds (ETFs). ETFs are mutual funds that stock up gold and then issue units for the same value for investors to trade.

ETFs allow normal investors to hold gold electronically in paperless form. According to World Gold Council estimates, ETF demand for gold in the first half of 2009 stood at over 500 tonnes, three times their annual levels five years ago.

Image: A rise in the Gold Exchange Traded Funds.

With the dollar losing its value, central banks of most of the developed countries have started to increase their share of gold. So there is a huge demand for gold.

The bulk of this growth will come from Asia led by China, India and the Middle East and is likely to have an immense impact on global precious metals demand. A high gold price is an indicator that all is not well with the global economy.

Here’s how emerging nations like India, China countries are triggering a demand for gold.

The India factor

Gold has always been a popular investment both jewellery and bullion in countries like India and China. India is the world’s largest consumer of gold. With a population of 1.1 billion people, gold has a great future in India. The Indian wedding season from December to May adds to the demand in gold. Any festive occasion is India sees a spurt in the demand. People even mortgage their properties to buy gold in India.

Image: Wedding season, festivals see huge demand for gold.

The China factor

Gold is a symbol of prosperity in China. China has also started investing more in gold. China has established gold exchanges. The Shanghai Gold Exchange has authorised the China Bank, China Industrial & Commercial Bank, China Constructional Bank and China Agricultural Bank as the banks for settling gold accounts.Middle East

Oil rich nations in the Middle East are investing more money in gold. Gold imports have risen steadily. Many OPEC countries have openly expressed their interest to move out of US dollar denominated assets.

Source : Rediff

With the dollar losing its value, central banks of most of the developed countries have started to increase their share of gold. So there is a huge demand for gold.

With the dollar losing its value, central banks of most of the developed countries have started to increase their share of gold. So there is a huge demand for gold.