World’s Top 10 Buyers & Producers of GOLD

Gold has held mankind enraptured since time immemorial. It has been prized for its beauty, easy workability, indestructibility, and value.

The average global demand for gold in the past 10 years has been mainly for jewellery at 76 per cent, followed by industrial applications of 14 per cent and 10 per cent for investors. The available gold supply is from new mining, reclaimed scrap, official or new bank sales and gold loans made from official reserves.

There are five international gold trading centres: New York, London, Zurich, Tokyo and Hong Kong.

India, world’s number one buyer of gold!

The craze for the yellow metal in India is phenomenal. It has traditionally been the world’s largest consumer of gold. India buys an average of 800 tonnes of gold every year and its total jewellery market is worth more than $20 billion.

However, in recent times the demand for gold in India has waned slightly, with the price of the precious metal zooming to record highs. Yet, the country remains the largest buyer of gold, at 770 tonnes in 2007.

Source: GFMS (Gold Field Mineral Services)

Image: A visitor admires a gold necklace on display at the Gem & Jewellery India International Exhibition 2009 in Chennai. | Photograph: Babu/Reuters

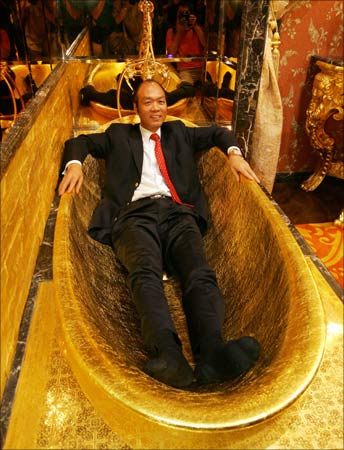

China: 2nd largest buyer; number one producer

Beijing has gold holdings of 1,054 tons, up from 600 tons in 2002, and still wants to buy more gold.

China produced 280.5 tons of gold in 2007, making it the world’s number one producer of the precious metal.

China is also the world’s second largest buyer of gold. It bought 328 tons of gold in 2007.

Source: GFMS (Gold Field Mineral Services)

Image: Lam Sai-wing, chairman of Hang Fung Gold Technology Group, poses in a golden bathtub in an exhibition hall decorated with two tonnes of gold next to his jewellery shop in Hong Kong. | Photograph: Bobby Yip/Reuters

USA: 3rd largest buyer; 4th largest producer

The United States of America is the world’s third highest buyer of gold. In 2007, it purchased 275 tons of the yellow metal.

However, the US is also the world’s fourth largest producer of gold. In 2007, it produced 240 tons of gold.

Source: GFMS (Gold Field Mineral Services)

Image: A worker checks the quality of a commemorative gold medal with the face of US President Barack Obama. | Photograph: Petr Josek/Reuters

Turkey: 4th largest buyer

Turkey is the world’s fourth largest buyer of gold. In 2007, it bought 250 tons of the precious metal.

Source: GFMS (Gold Field Mineral Services)

Image: Melted gold flows out of a smelter into a mould at a plant of gold refiner in Istanbul, Turkey. | Photograph: Osman Orsal/Reuters

Saudi Arabia: 5th largest buyer

Saudi Arabia purchased tons of gold in 2007, making it the world’s fifth largest buyer of gold.

Source: GFMS (Gold Field Mineral Services)

Image: A salesman arranges gold bangles and necklaces at a jewellery shop in downtown Riyadh, Saudi Arabia. | Photograph: Fahad Shadeed/Reuters

UAE: 6th largest buyer

The United Arab Emirates is the sixth largest gold-buyer at 107.2 tons (figures pertain to 2007).

Source: GFMS (Gold Field Mineral Services)

Image: A shopkeeper sits in his shop in Dubai’s gold souk. | Photograph: Tamara Abdul Hadi/Reuters

Russia: 7th largest buyer; 6th largest producer

The world’s seventh largest buyer of gold is Russia. In 2007, Moscow procured 85.6 tons of gold.

Russia is also a big producer of gold. In fact, it is the world’s sixth largest gold-producer. In 2007, it produced 169.2 tons of gold.

Source: GFMS (Gold Field Mineral Services)

Image: A visitor inspects a gold-and-jewel replica of a Russian Orthodox church made by Russian artists on display at a presentation for journalists in the Pushkin Museum in Moscow. | Photograph: William Webster/Reuters

Vietnam: 8th largest buyer

Vietnam bought 77.5 tons of gold in 2007, making it the world’s eighth largest gold-buyer.

Source: GFMS (Gold Field Mineral Services)

Image: Gold jewellery is displayed for sale at a shop in Hanoi. | Photograph: Kham/Reuters

Egypt: 9th largest buyer

Egypt follows in the ninth position. In 2007, it procured 69 tons of gold making it one of the biggest gold-buyers in the world.

Source: GFMS (Gold Field Mineral Services)

Image: The gold mask of ancient pharaoh king Tutankhamen seen at the Egyptian museum. | Photograph: Aladin Abdel Naby/Reuters

Italy: 10th largest buyer

Italy is the tenth largest buyer of gold in the world. In 2007, it purchased 59.2 tons of the yellow metal.

Source: GFMS (Gold Field Mineral Services)

Image: A visitor admires a gold bangle by jeweller Bruno Martinazzi of Italy. | Photograph: Alexander Demianchuk/Reuters

Source : Rediff